Continuous Manufacturing: Many Want It, But Here's Why Few Have It

By Ionna Deni, contract market researcher, BioPlan Associates

Continuous manufacturing remains a key objective among bioprocessing professionals. While continuous bioprocessing isn’t a new concept, having been applied in the production of both old and new products, significant technological advancements set the stage for its wider adoption.

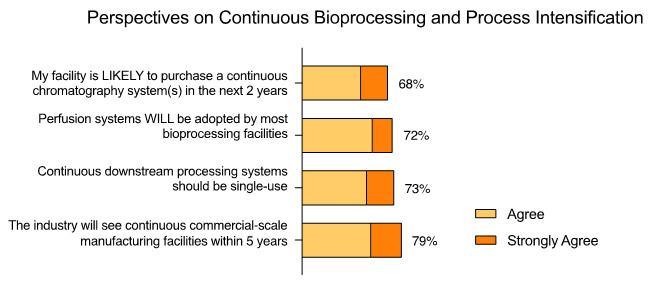

In fact, in our 20th Annual Report and Survey of Biopharmaceutical Manufacturing Capacity and Production we found that over 68% of facilities are likely to adopt a continuous chromatography system, at some scale, in the next two years (Fig. 1). Further, a large majority (72%) expect to see adoption of upstream perfusion in most facilities, according to the bioprocessing experts surveyed in the BioPlan study.

Despite these expectations, there are still significant variations in the adoption of continuous bioprocessing (CBP), particularly when looking at upstream and downstream processes. To date, only a select few CBP platforms have been implemented in a continuous mode. The delays in the widely anticipated integration of continuous bioprocessing into commercial manufacturing have numerous causes. A significant factor, according to our report, involves the perceived complexity, logistics, and skills required to operate in continuous mode.

The reasons themselves are complex, including the costs of switching, the added complexities of the processes, and a lack of clear guidance on transitioning from batch to continuous production. Due to these challenges, persistent batch-related bottlenecks, and the relatively slow productivity improvements in batch processing, the industry continues to seek out innovative continuous processing solutions. These efforts are directed toward achieving greater efficiency and reducing costs.

Meanwhile, suppliers have continued to evolve their technologies and to share more information about continuous bioprocessing options, including better off-the-shelf and single-use options compared to fully customized equipment. The clear potential of continuous bioprocessing is understood by the industry, but its broad adoption for more widespread commercial scale manufacturing may take longer than the expected five years.

Current Perceptions Of Continuous Manufacturing Trends

Operating bioprocesses in a continuous mode rather than batch brings numerous advantages recognized by industry experts. Many of these align with benefits of single-use and modular systems, and they include:

- Cost efficiency: Continuous operation requires smaller-scale equipment such as smaller bioreactors, leading to significant cost savings.

- Quality improvements: A continuous production of biological molecules allows for a more controlled environment. Continuous cultures usually add less stress on the cells, including reduced shear and stable nutrient levels in the media, enhancing product quality.

- Productivity: With equipment running continuously, there is the elimination of pauses for transfers of vessels and limited need for storage between processes.

- Adaptability: Continuous manufacturing offers greater flexibility in regard to the efficient use of facilities, similar to single-use devices. Continuous bioprocessing is more compact, and the facilities can be easier to replicate.

These benefits encompass not just operational efficiencies but also contribute to reduced risks and improved consistency and robustness compared to batch processing.

Fig 1: Perspectives on Continuous Bioprocessing and Process Intensification

Source: Report and Survey of Biopharmaceutical Manufacturing Capacity and Production, 20th annual edition, BioPlan Associates, April 2023

The highest percentage of survey responders, 79%, responded positively (54.8% agreed, 24.2% strongly agreed) that they will see continuous commercial manufacturing facilities in the next five years. There was additional consensus, with 73%, expecting to see a greater prevalence of single-use systems in continuous downstream bioprocesses.

Perfusion, a technique utilized in upstream continuous processing, which has been established for decades, yielded 72% of survey responders expecting its complete adoption. This was followed by implementation of continuous downstream systems and, more specifically, continuous chromatography with 68% (Fig. 1).

Most continuous chromatography systems today operate by alternating process flows across six or more columns, maintaining each column in batch mode. This technology is beginning to emerge from a few suppliers but remains complex in terms of operation, validation, and maintenance. It requires sophisticated automation to manage numerous valves during operation, which requires the recruitment of specialized personnel. In addition to these challenges, continuous chromatography technologies are also costly to purchase, thus they are less likely to be adopted in the near term than upstream continuous bioprocessing systems. Nevertheless, multi-column, countercurrent, and other variations of continuous chromatography units are advancing toward commercial viability, and they are overcoming regulatory hurdles such as lot definition.

Status Of Adoption Of Continuous Systems

Assessing worldwide demand for continuous bioprocessing and future implementation can also be achieved via measuring the proportion of the industry that is actively exploring these technologies. Since 2016, BioPlan’s annual survey has been reviewing the percentage of bioprocessing experts that are in the process of formally or informally evaluating at least one upstream or downstream continuous bioprocessing system.

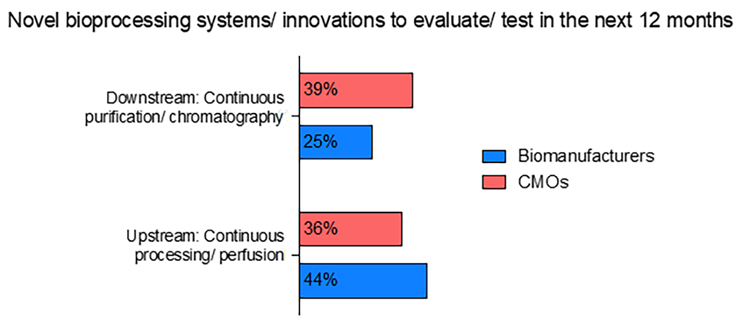

In 2023 there was a general decrease of activity in continuous systems evaluations, but there has been a steady interest in these systems for future considerations. These trends were further explored for biomanufacturers and contract manufacturing organizations (CMOs).

CMOs have been leading the way in adopting new technologies. According to the report, a larger percentage of CMOs are set to explore continuous downstream bioprocessing and process intensification technologies in the next 12 months. Specifically, 39% of CMOs plan to evaluate downstream technologies, such as continuous purification and chromatography, compared to 25% of biomanufacturing facilities. On the other hand, biomanufacturers remain in the front with 44% of them evaluating upstream continuous processing such as perfusion compared to 36% of CMOs (Fig. 2). Thus, CMOs are seen to primarily strive to explore newer technologies while biomanufacturers focus on completing the successful adoption of older, more established systems.

Fig 2: Novel Bioprocessing Systems/Innovations to Evaluate/Test in the Next 12 Months

Source: Report and Survey of Biopharmaceutical Manufacturing Capacity and Production, 20th annual edition, BioPlan Associates, April 2023

In the top 10 new product development areas identified for 2023, CMOs demonstrated a particular interest in continuous downstream technologies, especially chromatography, with over 50% showing enthusiasm. This interest level was the highest recorded among other areas for CMOs and the most significant percentage of interest in new product development areas among CMOs and biomanufacturers.

CMOs in general display a preference for cost-effective, single-use advancements in downstream processing, automation, and materials like cell culture media. This aligns with the industry's nature, as CMOs primarily concentrate on scaling up biopharmaceutical production. In contrast, traditional biomanufacturers typically operate across various manufacturing scales, including clinical-level production, with their primary goal being the refinement and development of new products rather than scaling up.

Single Use Adoption And Budgeting

In addition to these insights on continuous bioprocessing, the survey has shed light on the adoption of other bioprocessing technologies, reflected by the expenditures in new technology for 2023. Industry leaders reported the new technologies they planned to allocate budget for, and single-use products along with automation emerged as the top investment areas (42% and 40.9%, respectively).

Data suggests a trend toward investment in single-use innovations and devices that facilitate quick shifts between projects alongside growing interest in continuous bioprocessing solutions. Continuous bioprocessing was among the 10 investment technologies, with 20.2% for downstream and 17.1% for upstream processes.

In summary, the explicit interest in continuous manufacturing has not been reflected in the current evaluated technologies for wide adoption. Biomanufacturers and CMOs still show significant variations in the rate of adoption of continuous bioprocessing, particularly when looking at upstream and downstream processes.

The anticipation for continuous manufacturing is also not echoed in the suppliers’ budget allocations, where automation shows the highest investment interest. Therefore, using analysis of budgets as an indicator, despite the high expectations, fully integrating continuous bioprocessing systems into GMP bioprocessing will likely require more time.

The transformation to the continuous mode of manufacturing involves a complex preparation and assessment of its impact on the overall bioprocessing strategy compared to more commonly used batch technologies.

Challenges Of Wide Adoption Of Continuous Bioprocessing

Several aspects of bioprocessing continue to resist practical implementation in continuous mode. Downstream operations like cell harvesting and processing, including various filtration and certain chromatography procedures, remain in batch mode along with nearly all processes upstream of bioreactors, such as culture media preparation and bioreactor filling. In BioPlan’s report, significant areas of perfusion were also seen as more problematic compared to fed-batch. These included:

- operational complexity,

- process development,

- costs,

- contamination risks,

- upstream development and characterization time,

- validation, and

- cell line stability.

Perfusion has primarily been used for early-stage manufacturing compared to large or commercial-scale manufacturing. Perfusion systems add considerable mechanical complexity. Approximately 55.3% of survey responders believe that continuous upstream processing is too costly and more than 50% of them agreed that continuous upstream processing is too complex. Similarly, 62% of them find continuous downstream processing too early to adopt now.

Hiring Challenges Inhibiting CBP Adoption

Another challenge that adds to the complexities of continuous bioprocesses is the lack of expert staff. In 2023, the challenge of finding skilled personnel with expertise in the operation of continuous bioprocessing continues to be significant.

For industry leaders, the recruitment, training, and retention of such qualified individuals rank as top priorities amid ongoing concerns. Within the demands for process development staff, upstream and downstream ranked highest in the most challenging positions to fill, with 47.1% and 42.2%, respectively. The persistent need for experts in these categories likely reflects the pace at which advancements in both upstream and downstream processing are evolving, surpassing the industry's capacity to recruit qualified technicians equipped to manage these advancements.

Continuous Bioprocessing Takeaways

The industry’s overall growth and its ongoing demand for cost-efficient and adaptable manufacturing are clearly impacting professional experts’ expectations of wide adoption of continuous manufacturing. It is likely that continuous processing will eventually overcome many of its current challenges and, even if widespread adoption does not occur, the technologies around this platform are advancing, which will drive greater adoption.

Currently, there is no immediate urgency to rapidly adopt continuous bioprocessing for commercial manufacturing. Nevertheless, the current bottlenecks and the rate of batch processing improvements are encouraging advancements and developments in continuous bioprocessing solutions. Perfusion is already seeing more application in small to mid-scale operations.

Like trends with single-use systems, most bioprocessing operations, even those used at clinical scales, revert to batch mode for commercial production. However, there is potential for a surge in continuous processing adoption within the next few years, likely starting with upstream perfusion due to its operational advantages. Due to the complex logistical and engineering challenges at commercial scale, and the demand for expert personnel, it may require longer than the expected five years before continuous processing sees widespread use in manufacturing commercial products.

About the Author:

Ioanna Deni is a contract market research scientist for BioPlan Associates. She is an experienced quantitative market research analyst with a Ph.D. in biomedical sciences and extensive experience in biopharmaceutical life science research. Her research background includes quantitative and qualitative market research expertise as an AI and healthcare specialist at Intelligence Ventures. info@bioplanassociates.com, 301-921-5979, www.bioplanassociates.com.